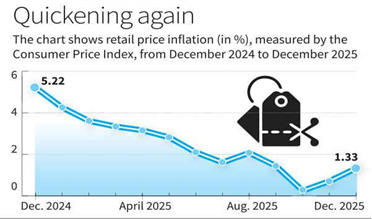

Retail inflation

Retail inflation at 3-month high of 1.33% in December

Context: Increased figure still below RBI’s lower comfort level of 2%; data show broad-based decline in price levels across sectors as reason for low figure; core inflation at 28-month high of 4.8%, says expert.

- India’s retail inflation quickened to a three-month high of 1.33% in December 2025, which is still significantly below the lower comfort level of 2% set by the Reserve Bank of India (RBI), official data released showed.

- Data on the Consumer Price Index for December 2025, released by the Ministry of Statistics and Programme Implementation, show that the low levels of retail inflation are a result of a broad-based decline in price levels across sectors. The RBI targets an inflation rate of 4%, with a comfort band of 2% above and below that.

- The food and beverages category saw a contraction of 1.85% in prices in December 2025, a moderation from the contraction of 2.8% seen in November. This is likely due to a high base effect as inflation in this category stood at 7.7% in December last year.

- “However, inflation was high at over 5% for meat products, oils, and fruits and will continue to exert upward pressure in the coming months,” Madan Sabnavis, chief economist at the Bank of Baroda said.

- Inflation in the ‘pan, tobacco, and intoxicants’ category remained unchanged at 2.96% in December 2025 as compared to November. The clothing and footwear category saw inflation easing marginally to 1.44% in December 2025 from 1.49% in the previous month. Inflation in this category had been 2.7% in December 2024. The housing sector, too, saw inflation easing to 2.86% in December 2025 from 2.95% in the previous month. The fuel and light category saw inflation ease to 1.97% in December 2025, as compared to 2.3% in November.

- “Core inflation (CPI excluding food and beverages, fuel and light, and petrol and diesel for vehicles) jumped to a 28-month high of 4.8% in December 2025 from 4.4% in November 2025,” Aditi Nayar, chief economist and head, research & outreach at ICRA Limited said. “However, this was largely led by precious metals; core CPI excluding gold and silver remained unchanged at 2.4% between these months.”

Source: The Hindu