UPSC/KPSC Current Affairs: 2nd December 2025

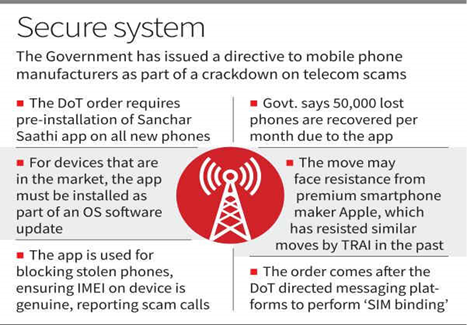

Smartphone makers toldto pre-install Sanchar Saathi

Context: The Department of Telecommunications (DoT) ordered smartphone manufacturers to pre-install the Sanchar Saathi app on new devices sold from March 2026, and to make sure “that [the app’s] functionalities are not disabled or restricted”

- The app will be used to “verify authenticity of IMEIs used in mobile devices”, the order said.

- It is unclear if the app will have access to the IMEI number of devices it is pre-installed on, or if users will have to input the hardware identifier on their own.

- The app can be used to report scam calls, identify SIM cards registered under a person’s name, and remotely disable phones if they are stolen.

- It must be installed on devices sold from March, govt. tells phone makers; move will help safeguard people from buying non-genuine handsets and enable easy reporting of telecom resource misuse

- The Department of Telecommunications (DoT) ordered smartphone manufacturers to pre-install the Sanchar Saathi app on new devices sold from March 2026, and to make sure “that [the app’s] functionalities are not disabled or restricted”.

- The Sanchar Saathi app will be used to “verify authenticity of IMEIs used in mobile devices,” the order said. It is unclear if the app will have access to the IMEI number of devices it is pre-installed on, or if users will have to input the hardware identifier on their own.

- In a statement, the DoT said the move was meant to “safeguard the citizens from buying the non-genuine handsets, enabling easy reporting of suspected misuse of telecom resources and to increase effectiveness of the Sanchar Saathi initiative”. The Sanchar Saathi app, first introduced as a portal in 2023, has been used to report scam calls, enable users to identify SIM cards registered in their name, and remotely disable phones if they are stolen. It is much like the Telecom Regulatory Authority of India’s (TRAI) DND app, the commercial spam equivalent.

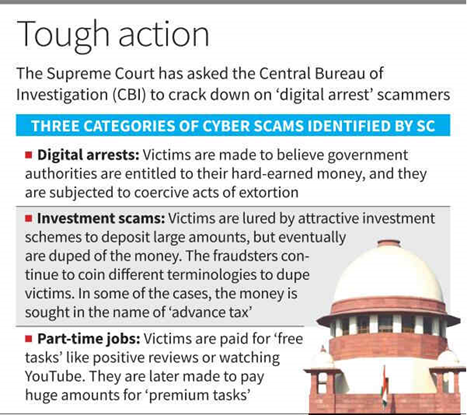

- SC gives CBI free hand to stop ‘digital arrest’ scams

Context: It says every type of scam defrauding victims, especially senior citizens, needs to be investigated; court directly ordering CBI, overriding state consent, to conduct probe is an extraordinary step.

- The Supreme Court tasked the Central Bureau of Investigation with cracking down on ‘digital arrest’ scammers and their associates, giving the agency a “free hand” to launch an anti-corruption probe into bankers involved in the opening of mule accounts linked to cybercrimes.

- A Bench of the Chief Justice of India Surya Kant and Justice Joymalya Bagchi found “enough was enough”, and held that ‘digital arrest’ scams required the immediate attention of the CBI. A note provided by the Centre in the court showed that ₹3,000 crore had already been scammed by fraudsters from victims, mostly drawn from the elderly population, through ‘digital arrests’.

- “There is no second opinion that every type of cyberscam defrauding victims, especially senior citizens, is required to be investigated. The CBI shall investigate first the digital arrest scams. Other types of cyberscams [fraudulent investments, promise of part-time jobs] can come in the second and third stages,” the court observed in the order.

- The court directly ordering the CBI, overriding state consent, to conduct a pan-India probe and hunt down scammers is an extraordinary step. It cannot order the CBI, except when compelled by exceptional circumstances.

- Bihar, Tamil Nadu, Karnataka, Kerala, West Bengal, Madhya Pradesh, Uttarakhand, Rajasthan, Punjab, Maharashtra, Meghalaya, Jharkhand, and Tripura have been directed to accord consent to the CBI under Section 6 of the Delhi Special Police Establishment Act to investigate ‘digital arrest’ cases under the Information Technology Act, 2000 in their jurisdictions.

- The court directed the CBI to identify police officers from different States, and domain experts, to aid the investigation. “We want the CBI to undertake a comprehensive investigation on identified cybercrimes on a pan-India basis,” Chief Justice Kant observed.

- Considering the magnitude of the ‘digital arrest’ scams and widespread tentacles of the fraudsters, the Supreme Court directed the CBI to coordinate with the Interpol to identify cybercrime havens abroad. The court impleaded and issued notice to the Reserve Bank of India to respond on the use of Artificial Intelligence and Machine Learning to trace ‘layering’ or the moving of the proceeds of crime through multiple bank accounts to escape detection.

- Invoking the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules of 2021, the apex court directed online intermediaries to cooperate with the CBI, and provide the agency assistance with regard to data in connection with investigation into ‘digital arrest’ cases.

- States and Union Territories have to ensure the establishment and operationalisation of regional cybercrime coordination centres to compile data on cybercrimes, and for initiating preventive measures against the offence, the court directed. They should be linked to the Indian Cybercrime Coordination Centre (I4C), which is designed to provide an ecosystem for law enforcement agencies to deal with cybercrime in a coordinated and comprehensive manner.

- The court said telecom operators had been careless in issuing SIM cards.

- Soon, digital e-stamping will be mandatory

Context: More than two decades after the e-stamp facility was launched, Karnataka will soon replace it with mandatory digital e-stamping for registerable and non-registerable documents.

- More than two decades after the e-stamp paper facility was launched, Karnataka will replace it with mandatory digital e-stamping for both registerable and non-registerable documents shortly.

- The new facility, which will become mandatory over the next few weeks, will not only bring convenience to public to get the stamp paper from the comforts of their home, but will also prevent misuse, including creating fake stamp papers.

Ease of buying

- From approaching a stamp paper vendor on specified days and time currently, the new facility will provide the ease of buying stamp paper online 24/7 from the comforts of home.

- Not only has it been made fully online, it is also not amenable to any tampering, the government claimed on Monday.

- While earlier if a stamp paper document was lost, public could not retrieve it, under the new facility, since the government will maintain digital record, documents can be retrieved using QR code.

- The e-stamping facility was introduced in Karnataka following the multi-crore fake stamp paper racket was unearthed in 2002-2003. Over the years, revenue from e-stamp paper has brought in substantial revenue to the government.

- If the stamp duty of about ₹45.90 crore was collected in 2009-2010 by issuing about 5.92 lakh certificates, it has gone up to about ₹2,320 crore in 2024-2025 when about 3.07 crore certificates were issued.

Misuse of e-stamp

- “The government has observed misuse of e-stamp papers. The misuse has been happening for several years. The misuse includes printing of e-stamp and taking colour photocopies of it. The e-stamp was also being misused to pay lesser pay than what was supposed to be paid,” Revenue Minister Krishna Byre Gowda told presspersons here on Monday.

- He said that there were 54 classifications for registerable documents whose fees varied from a few hundreds to several thousands. “However, for transactions where several thousands had to be paid as duty, a ₹100 worth stamp paper was being bought, which is mis-classification. This was resulting in losses to the exchequer,” he said, adding that several such cases had been reported.

Tech upgrade

- The Minister said that the digital e-stamp had been mandated for registerable and non-registerable documents. “It has been noticed that nearly half of the non-registerable documents are used to file affidavits. With the changing times, the government has also moved up in the technology.”

- Centre moves Bills for pan masala cess and higher duties on tobacco products

Context: The Union government on Monday introduced a Bill in Parliament seeking to raise the excise duty on tobacco products, and another legislation targeting the manufacture of pan masala.

- Union Finance Minister Nirmala Sitharaman tabled the two Bills — The Health Security se National Security Cess Bill, 2025 and the Central Excise (Amendment) Bill, 2025 — amid Opposition sloganeering. The Bills are aimed at replacing the revenue from the Goods and Services Tax (GST) compensation cess on tobacco products, which will be discontinued soon. The Health Security se National Security Cess also proposes to augment funding for health and national security through levy of cess on “machines installed, or other processes undertaken in the manufacture of pan masala”.

Launched in 2017

- The GST compensation cess was introduced in 2017 during the launch of the GST system. The proceeds were to be used to compensate States for any losses they faced due to the implementation of GST for a period of five years. During the COVID-19 pandemic years of 2020-21 and 2021-22, the proceeds from this cess fell short of the compensation requirement, leading to the Centre borrowing money to compensate the States.

- The compensation cess on tobacco products is to be discontinued once the government pays back interest on these loans.

- According to sources in the Ministry of Finance, this repayment will be completed in the next few months.

- However, with the removal of this cess, the effective tax rate on and revenues from tobacco products would fall significantly.

- To overcome this shortfall in revenue, the Central Excise (Amendment) Bill has been introduced “in order to give the government, the fiscal space to increase the rate of Central excise duty on tobacco and tobacco products so as to protect tax incidence”.

- “With the levy of GST and compensation cess on tobacco and tobacco products, the rates of central excise duties were reduced significantly to allow for the levy of compensation cess without large impact on their tax incidence,” the ‘Statement of objects and reasons’ of the Bill said.

- The Health Security se National Security Cess Bill seeks to “augment the resources for meeting expenditure on national security and for public health” by levying a cess on the “machines installed, or other processes undertaken in the manufacture of pan masala”.

- The Bill also allows for the imposition of this cess on “any other goods which may be notified”.

- “The cess is linked to the production capacity of machines or other processes rather than the quantity actually produced of such specified goods,” according to the ‘Statement of objects and reasons’ of the Bill.

- E-swathu 2.0 rolled out for property owners in rural areas

Context: In a bid to provide convenience to property owners in rural areas to get their documents without a hitch, the State government launched e-swathu 2.0.

- The facility was launched by Chief Minister Siddaramaiah at a function where Gandhi Grama Puraskara was conferred on 238 gram panchayats across the State, selected for the year 2023-2024.

- Mr. Siddaramaiah said that people’s participation would strengthen democracy, and gram panchayats should become power centres. The selected gram panchayats were given ₹5 lakh and a memento.

Increasing resources

- Rural Development and Panchayat Raj Minister Priyank Kharge explained that legislation and rules had been brought to bring properties under tax net to increase the resources of gram panchayats. Till now, gram panchayats were providing drinking water, streetlights, roads and drainage facilities to properties that remained outside the panchayat limits and were developed without land conversion, and that it was causing financial strain on the gram panchayats.

- “Now these properties are being brought under tax net. The e-swathu 2.0 will help public to get the e khatha document for their properties. The whole process will be quick and transparent,” the Minister said. He also warned of possible teething problems in the initial days of the e-swathu being rolled out.

- Deputy Chief Minister D.K. Shivakumar said that the public should make use of the facility, and that there was no need for people to run from pillar to post. “Pay tax through 11B and register the properties,” he said.

- Bioterrorism a serious threat, world not ready: Jaishankar

Context: Union Minister warns that ‘non-state actors’ can use biological agents; he says such threats cannot be handled in isolation, pitches for keeping Global South at the centre of strategies to tackle them.

- The world is not yet “adequately prepared” to deal with the threat of bioterrorism, External Affairs Minister S. Jaishankar.

- Speaking at a conference on 50 years of the Biological Weapons Convention (BWC), Mr. Jaishankar said “non-state actors” can resort to use of biological agents and that the Global South should be at the centre of preparations to deal with bioweapons.

- “Bioterrorism is a serious concern that the international community has to be adequately prepared for. Yet the BWC still lacks basic institutional structures,” said Mr. Jaishankar.

‘No compliance system’

- “It has no compliance system, it has no permanent technical body and no mechanism to track new scientific developments. These gaps must be bridged in order to strengthen confidence,” said the Minister, calling for BWC’s modernisation.

- He said India has proposed a National Implementation Framework that will cover “high-risk agents, oversight of dual-use research, domestic reporting and incident management”.

- Mr. Jaishankar said India is “committed to ensuring the non-proliferation of sensitive and dual-use goods and technologies”, and this has been supported by India’s strong legal and regulatory system.

Role of Global South

- The Minister said biological threats cannot be handled by countries in isolation from international stakeholders and called for making the Global South central to BWC.

- He described “unequal access to vaccines and medicines” as not just development issues but as “global risks”.

- “The Global South is the most vulnerable and has the most to gain from stronger biosecurity. It also has the most to contribute. Its voice must therefore shape the next 50 years of the BWC,” said Mr. Jaishankar, who highlighted India’s ‘vaccine diplomacy’ that took shape against the backdrop of the COVID-19 pandemic.

- Armed forces to procure additional Heron Mk II UAVs

Context: To enhance their unmanned capabilities in the wake of Operation Sindoor, the Indian armed forces have signed up for more satellite-linked Heron Mk II Unmanned Aerial Vehicles under emergency procurement, sources in the Israeli defence industry said.

- According to the sources, the Army and Air Force, which already operate Heron Mk II drones, have placed additional orders while the Indian Navy is acquiring them for the first time. The Navy, which has long relied on Israeli-made Searcher UAVs for surveillance, will soon transition to the more advanced Heron Mk II platform.

- As per existing guidelines, under emergency procurement, armed forces can procure weapons systems, including entire systems, up to ₹300 crore.

- The Heron family, especially the Heron Mk II, has emerged as a key component of evolving combat environments due to its versatility and proven reliability. Indian Army has deployed these drones at forward bases in northern sector.

- In line with India’s push for defence indigenisation, several Israel defence industries, including state-owned defence manufacturers, are working with defence PSUs and private partners to enhance local production. The companies are also creating training, maintenance and integration capabilities within India, the official said.

- Lok Sabha passes Manipur GST Bill amid disruptions over SIR

Context: The Bill replaces an Ordinance which implemented reforms in Goods and Services Tax in Manipur; statutory resolution moved by Revolutionary Socialist Party member N.K. Premachandran disapproving the Bill was rejected by a voice vote.

- The Lok Sabha, on the first day of the Winter Session on Monday, passed a Bill to replace an Ordinance which implemented reforms in the Goods and Services Tax (GST) in Manipur.

- There were frequent disruptions as the Opposition insisted on a debate on the special intensive revision (SIR) of electoral rolls under way in nine States and three Union Territories.

- Union Finance Minister Nirmala Sitharaman introduced the Manipur Goods and Services Tax (Second Amendment) Bill, 2025 in the afternoon, after one round of disruption.

- The Bill was passed post-lunch after a brief discussion, and a statutory resolution moved by Revolutionary Socialist Party (RSP) member N.K. Premachandran disapproving the Bill was rejected by a voice vote as Opposition members were protesting in the Well of the House. As soon as the House assembled on Monday, Speaker Om Birla began proceedings by paying respects to former members who passed away recently.

- Mr. Birla then congratulated the women’s teams for winning the ICC World Cup 2025 and the T20 Cricket World Cup for the Blind; the women’s kabaddi team that won the World Cup; and the athletes representing India at the Deaflympics.

- But as soon as the Question Hour was taken up, Opposition members started shouting slogans pressing for a discussion on the SIR. Mr. Birla tried running the House for about 20 minutes before adjourning until noon.

- When the House reassembled, Ms. Sitharaman introduced three Bills, including one to levy excise duty on tobacco and tobacco products and another to impose a new cess on the manufacture of pan masala, apart from tabling supplementary demands for grants for 2025-2026. The House functioned for about 12 minutes before it was adjourned until 2 p.m.

- When the House met at 2 p.m., Telugu Desam Party (TDP) member Krishna Prasad Tenneti, who was in the Chair, called Mr. Premachandran to speak on the resolution, but the RSP member told the presiding officer that the House was not in order.

- The Chair then called BJP member Shashank Mani, who spoke in favour of the Bill.

- The Bill was then passed by a voice vote amid vociferous protests by Opposition parties, who trooped into the Well of the House. Following this, the House was adjourned for the day.

- Army conducts combat launchof BrahMos cruise missile

Context: The Indian Army carried out a combat launch of the BrahMos supersonic cruise missile from a test range in the Bay of Bengal.

- The Ministry of Defence confirmed that the mission was executed through a precisely coordinated effort involving a BrahMos unit of the Southern Command and elements of the Tri-Services Andaman & Nicobar Command. Lt. Gen. Dhiraj Seth, General Officer Commanding-in-Chief, Southern Command, lauded the successful combat launch. The launch boosts the Army’s long-range strike capability and deterrence.

- CAD moderates to $12.3 billion in Q2

Context: India’s current account deficit (CAD) moderated to $12.3 billion (1.3% of GDP) in Q2 FY26 from $20.8 billion (2.2% of GDP) in Q2 FY25. Merchandise trade deficit at $87.4 billion in Q2 FY26 was lower than $88.5 billion in the same period last year, as per preliminary data on India’s balance of payments (BoP) for the second quarter, [July-September 2025-26], released by the RBI.

- Net services receipts increased to $50.9 billion in Q2 FY26 from $44.5 billion a year ago. Services exports have risen on a year-on-year basis in major categories such as computer services and other business services.

- Net outgo on the primary income account, mainly reflecting payments of investment income, increased to $12.2 billion in Q2 FY26 from $9.2 billion in the year-ago period.

- Personal transfer receipts under secondary income account, mainly representing remittances by Indians employed overseas, rose to $38.2 billion from $34.4 billion a year ago. In financial account, FDI recorded a net inflow of $2.9 billion as against a net outflow of $2.8 billion in the corresponding period of the previous year.

FPI outflow

Foreign portfolio investment (FPI) recorded a net outflow of $5.7 billion as against a net inflow of $19.9 billion a year ago. Net inflows under external commercial borrowings (ECBs) to India amounted to $1.6 billion compared with net inflows of $5 billion in the year ago period.

- Why does India need bioremediation?

Context: Human waste is leading to a world where access to clean air, water and soil is becoming increasingly difficult. The solution is two-pronged — reduce waste and clean up the waste already made.

What is bioremediation?

- Bioremediation literally means “restoring life through biology.” It harnesses microorganisms such as bacteria, fungi, algae and plants to sequester or transform toxic substances such as oil, pesticides, plastics, or heavy metals. These organisms metabolise these pollutants as food, breaking them down into harmless by-products such as water, carbon dioxide, or organic acids. In some cases, they can convert toxic metals into less dangerous forms that no longer leach into the soil or groundwater.

- There are two broad types of bioremediation — in situ bioremediation, where treatment happens directly at the contaminated site such as when oil-eating bacteria is sprayed on an ocean spill; or ex situ bioremediation, where contaminated soil or water is removed, treated in a controlled facility, and returned once cleaned.

- Modern bioremediation combines traditional microbiology with cutting-edge biotechnology. New biotechnologies are enabling humans to gain unprecedented insight into biology, allowing them to identify biomolecules with useful characteristics. These technologies also allow humans to replicate biomolecules under desired conditions of use, such as in sewage plants or agricultural lands. For example, genetically modified (GM) microbes are designed to degrade tough chemicals like plastics or oil residues that natural species struggle with.

Why does India need it?

- India’s rapid industrialisation has come at a heavy environmental cost. Although pollution has been reducing, rivers such as the Ganga and Yamuna receive untreated sewage and industrial effluents daily. Oil leaks, pesticide residues, and heavy-metal contamination threaten both ecosystems and public health.

- Traditional clean-up technologies are expensive, energy-intensive, and often create secondary pollution. Bioremediation offers a cheaper, scalable, and sustainable alternative, especially in a country where vast stretches of land and water are affected but resources for remediation are limited. Moreover, India’s diverse biodiversity is a huge advantage. Indigenous microbes adapted to local conditions, such as high temperatures or salinity, can outperform imported strains.

Where does India stand today?

- Bioremediation is gaining traction in India, though still largely in pilot phases. The Department of Biotechnology (DBT) has supported several projects through its Clean Technology Programme, encouraging partnerships between universities, public research institutions, and industries.

- The CSIR-National Environmental Engineering Research Institute has a mandate to propose and implement programmes related to bioremediation. Researchers at the Indian Institute of Technology have experimented with a nanocomposite material synthesised from cotton that can be used to mop up oil spills and others have identified bacteria that can consume toxic pollutants in soils.

- Startups are also entering the space. Firms like Biotech Consortium India Limited (BCIL) and Econirmal Biotech offer microbial formulations for soil and wastewater treatment.

- However, widespread adoption faces challenges such as a lack of site-specific knowledge and the complex nature of pollutants, and a lack of unified bioremediation standards.

What are other countries doing?

- Japan integrates microbial and plant-based cleanup systems into its urban waste strategy. The European Union funds cross-country projects that use microbes to tackle oil spills and restore mining sites. China has made bioremediation a priority under its soil pollution control framework, using genetically improved bacteria to restore industrial wastelands.

- The opportunities for India are immense. Bioremediation can help restore rivers, reclaim land, and clean industrial sites, while creating jobs in biotechnology, environmental consulting, and waste management. It can also integrate with the government’s Swachh Bharat Mission, Namami Gange, and other green technology initiatives.

What are the risks?

- The introduction of genetically modified organisms into open environments need to be strictly monitored to prevent unintended ecological effects. Inadequate testing or poor containment can create fresh problems while solving old ones. Public engagement will be necessary to allow the smooth adoption of new technologies. India will need new biosafety guidelines, certification systems, and trained personnel to scale this technology responsibly

What next?

- First, there is a need to develop national standards for bioremediation protocols and microbial applications. Second, building regional bioremediation hubs linking universities, industries, and local governments would enable better understanding of local issues and identifying appropriate technologies for their resolution. Finally, public engagement would raise awareness that microbes can be allies, not threats, in environmental restoration.

- Can India become self-reliant in REE production?

How is China using its dominance over rare earth elements as a geopolitical strategy?

- The Union Cabinet has approved a ₹7,280-crore scheme to manufacture rare earth permanent magnets domestically. The scheme would facilitate the creation of integrated Rare Earth Permanent Magnet (REPM) manufacturing facilities, involving the conversion of rare earth oxides to metals, metals to alloys, and alloys to finished REPMs. This announcement comes at a time when China’s export controls are squeezing global supply chains.

What is extent of China’s dominance?

- Rare earth elements (REEs), a group of 17 minerals, are crucial for their high density, melting point and conductivity. They are moderately abundant, but hard to extract economically and sustainably. China built global supremacy in this sector by controlling 90% of global REE processing and 70% of production, despite holding only 30% of global reserves. In April, China imposed export restrictions on seven rare earth elements and finished magnets, in a bid to counter the trade war. This hit many sectors, especially the automobile sector. “EV makers are the worst hit,” said Pranay Kotasthane, deputy director of Takshashila Institution.

- Though China’s controls come amid a broader reshaping of global trade due to U.S. President Donald Trump’s tariffs, they are not new. In 2009, Beijing imposed export quotas on REEs which was scrapped after it lost a World Trade Organisation case brought by the U.S. and others in 2015. “China realised that this is something which it can play in order to achieve its geopolitical, geostrategic and geoeconomic objectives. They played the same playbook in 2020 while restricting the export of graphite. In 2021, they started an export licensing plan in which they started restricting the supplies to certain industries,” Dr. Ram Singh, Professor (IB), Head (CDOE), Indian Institute of Foreign Trade, explained.

Why is India focusing on REEs?

- India’s focus on REEs is driven by its ambitions in electric mobility, renewable energy, electronics manufacturing and defence. These industries depend heavily on rare earth magnets and components.

- The country imported over 53,000 metric tonnes of REE magnets in FY 2024-25, despite having 8% of the world’s REE reserves — mainly in monazite sands across Andhra Pradesh, Odisha, Tamil Nadu and Kerala. Yet, India produces less than 1% of global output. To fix this, the government launched the ₹16,300 crore National Critical Mineral Mission in January, with a total outlay of ₹34,300 crore spread over seven years, to achieve self-reliance. The mission focuses on exploration, processing, and recycling minerals like lithium, cobalt, and rare earths. To boost domestic production, the government has auctioned new mining blocks and is inviting private companies to participate in exploration and processing. “This sector was closed to the private sector until August 2023 and hence this is a new domain. China’s restrictions will help generate interest among private players,” Mr. Kotasthane said. However, he points out that only a handful of exploration licences were handed out. “The stumbling block is government regulations and control. Deregulating all segments of this supply chain, fast-tracking environmental regulations, and funding exploration projects to reduce information asymmetry is crucial,” he said.

- Dr. Singh cautioned that India still lacks refining infrastructure, skilled labour and innovation capacity. He also pointed out that domestic manufacturing would take years to take off given the long gestation period.

- “The good thing is that India isn’t in a particularly bad position,” Mr. Kotasthane said, pointing out that India’s monazite sands have several light rare earths, including Neodymium, which are used in magnets. “Several companies have plans to substantially increase capacity in the rare earth magnet recycling space from end-of-life electronic devices and appliances,” he added.