Context: The Reserve Bank of India (RBI) has recommended to the Centre that a proposal connecting the central bank digital currencies (CBDCs) of BRICS countries be included on the agenda for the 2026 summit of the grouping, two sources have said.

- The proposal seeks to make cross-border payments easier, in a move that could reduce reliance on the U.S. dollar as geopolitical tensions rise. The RBI’s recommendation builds on a 2025 declaration at the BRICS summit in Brazil, which pushed for interoperability between members’ payment systems to make cross-border transactions more efficient.

- The RBI has publicly expressed interest in linking India’s digital rupee with other nations’ CBDCs to expedite cross-border transactions and bolster its currency’s global usage. It has, however, said its efforts to promote the rupee’s global use are not aimed at promoting de-dollarisation.

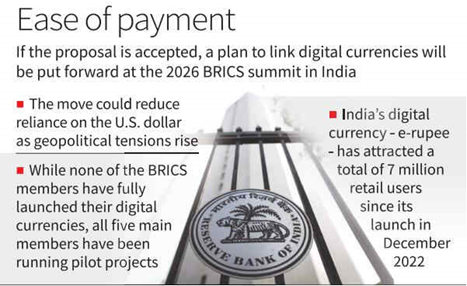

- India will host the next BRICS summit later this year. If the RBI’s recommendation is accepted, a proposal to link the digital currencies of BRICS members would be put forward for the first time. The BRICS includes Brazil, Russia, India, China, and South Africa, among others. The initiative could irritate the U.S., which has warned against any moves to bypass the dollar. U.S. President Donald Trump has previously said the BRICS alliance is “anti-American” and he threatened to impose tariffs on its members.

- While none of the BRICS members have fully launched their digital currencies, all five main members have been running pilot projects.

- India’s digital currency — the e-rupee — has attracted a total of 7 million retail users since its launch in December 2022, while China has pledged to boost the international use of the digital yuan.

- The RBI has encouraged the adoption of the e-rupee by enabling offline payments, providing programmability for government subsidy transfers and by allowing fintech firms to offer digital currency wallets.

- The RBI and the central bank of Brazil did not respond to emails seeking comment. The People’s Bank of China said it had no information to share on the subject in response to a request for comment; the South African and Russian central banks declined to comment.

- For the BRICS digital currency linkages to be successful, elements like interoperable technology, governance rules and ways to settle imbalanced trade volumes would be among the discussion topics, one of the sources said.

- The source cautioned that hesitation among members to adopt technological platforms from other countries could delay work on the proposal and concrete progress would require consensus on tech and regulation.

- One idea that is being explored to manage potential trade imbalances is the use of bilateral foreign exchange swap arrangements between central banks, both the sources said.

- Previous attempts by Russia and Indian government to conduct more trade in their local currencies hit roadblocks.

- Russia accumulated large balances of the Indian rupee for which it found limited use, prompting India’s central bank to permit the investment of such balances in local bonds.

- Weekly or monthly settlements for transactions are being proposed to be made via the swaps, the second source said.