Context: As the scale of economic loss escalates, disaster risk finance has moved to the forefront of policy.

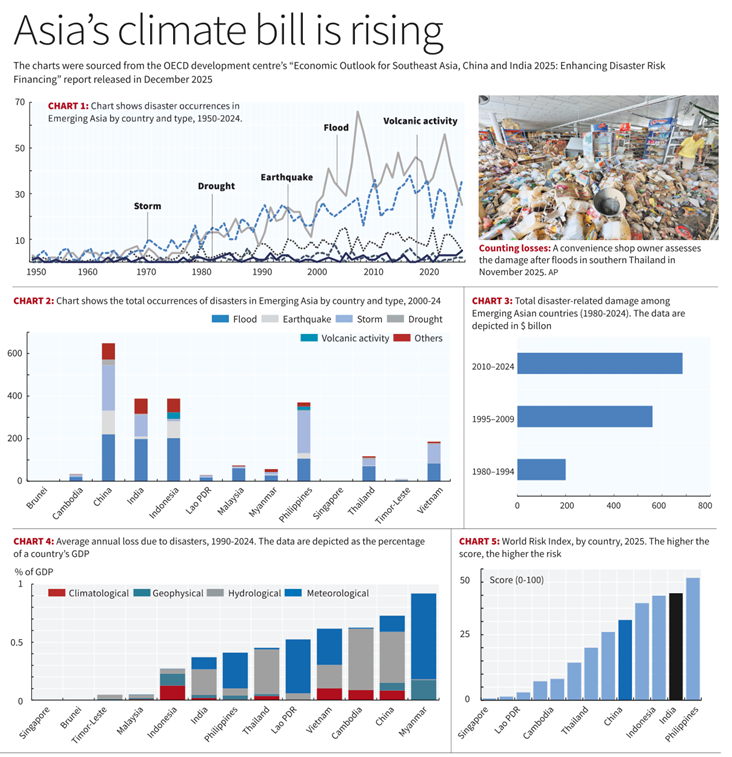

- Emerging Asian economies that comprise India, China, and the ASEAN-11, face an escalating threat from natural disasters that are growing in both frequency and intensity (Chart 1).

- Over the past decade, the region has had an average of 100 disasters annually, impacting approximately 80 million people.

- The nature of these threats varies by geography: while floods and storms are the primary drivers of risk in India, tropical cyclones frequently batter the Philippines and Vietnam.

- Meanwhile, China and Indonesia contend with significantly higher seismic risks (Chart 2).

- The human and economic toll of this vulnerability has been punctuated by several landmark catastrophes.

- As the scale of economic loss escalates (Chart 3), disaster risk finance has moved to the forefront of regional policy. To design an effective response, governments must first establish a data-driven foundation.

- From 1990 to 2024, India sustained average annual disaster-related losses equivalent to 0.4% of GDP (Chart 4). The composition of these losses is geographically distinct. India’s vulnerability is primarily hydrological (non-storm-related floods and landslides), whereas Myanmar’s losses are predominantly meteorological (extreme temperatures and cyclonic storms).

- The regional risk framework also includes climatological factors (drought and wildfire), and geophysical hazards (seismic activity and volcanic eruptions) too. Among the Asian economies analysed, India ranks second only to the Philippines in the World Risk Index (Chart 5). The index calculates risk as the geometric mean of exposure (population burden) and vulnerability (a combination of structural susceptibility, coping capacity, and long-term adaptation).

Source: The Hindu